FINANCIAL DEVELOPMENT, GROWTH ECONOMIC, STOCK PRICE VOLATILITY PERUSAHAAN ENERGI DALAM GEJOLAK PANDEMI

DOI:

https://doi.org/10.35590/jeb.v9i1.4142Keywords:

Pandemi, Rantai Pasokan, Sektor Keuangan, Pertumbuhan Ekonomi, Volatilitas Harga Saham, EnergiAbstract

Pandemi telah menjadi sebuah krisis yang menjadikan mobilasasi masyarakat terbatas karena peningkatan penyebaran virus dan angka kematian di berbagai negara. Memicu terputusnya rantai pasokan sehingga menurunkan produktivitas perusahaan. Penurunan produksi yang terjadi berakibat pada perlambatan ekonomi. Kondisi ekonomi didorong oleh peranan sektor keuangan sebagai financial intermediary yang akan memberikan suntikan modal bagi perusahaan dan memicu aktivitas perdagangan saham di pasar modal. Perekonomian diukur melalui proksi PDB sedangkan financial development melalui proksi rasio kredit sektor swasta dan kapitalisasi pasar terhadap PDB. Sementara, dependen utama pada model mediasi adalah volatilitas harga saham. Dari penelitian ini, ditemukan bahwa rasio kredit sektor swasta dan kapitalisasi pasar terhadap PDB memiliki pengaruh tidak langsung terhadap volatilitas harga saham pada perusahaan sektor energi tahun 2018-2020. Penyebabnya adalah prioritas masih dalam kredit konsumtif sehingga jumlahnya mengalami kenaikan dan rendahnya literasi keuangan masyarakat indonesia untuk melakukan aktivitas investasi pada perusahaan domestik. Model estimasi regresi yang digunakan adalah common effect model dengan metode pooled least square. Jumlah sampel penelitian sebanyak 10 perusahaan dalam kurun waktu kuartal 1 tahun 2018 hingga kuartal 4 tahun 2020. Penelitian ini diharapkan dapat membantu para investor dalam memberikan informasi mengenai faktor yang dibutuhkan saat melakukan analisis fundamental. Juga memberikan kritikan kepada pemerintah karena pemulihan ekonomi belum selesai dan dibutuhkan goodwill dalam merumuskan dan mengimplementasikan kebijakan moneter dan fiskal dalam upayanya melindungi jumlah investasi yang ada di Indonesia.

References

Detzer, Daniel; Herr, Hansjörg. 2014.” Theories of Financial Crises: An Overview.” Working Paper: Institute for International Political Economy BerlinTheories, no.32: 1-43

Patrick, Shrout & Bolger, Niall. 2014. “Mediation in Experimental and Nonexperimental Studies: New Procedures and Recommendations.” Journal of Colombia University, (May): 1-26

Makokha, Keren Chiteri. 2015.” The Effect of Over Confidence Bias on Stock Returns of Companies Listed At The Nairobi Securities Exchange.”Journal of Nairobi University, (October):19-53

Škare, Marinko; Hasić, Tea. 2016.”Corporate Governance, Firm Performance, And Economic Growth – Theoretical Analysis.”Journal Of Business Economics And Management, no. 17 (January) :35-51

Gautam, Ramji. 2017.” Impact Of Firm Specific Variables On Stock Price Volatility And Stock Returns Of Nepalese Commercial Banks.” SAARJ Journal On Banking & Insurance Research, no. 6 (June) :1-10

Durusu-Ciftci, Dilek Ispir; M. Serdar; Yetkiner, Hakan. 2017.” Financial Development And Economic Growth: Some Theory And More Evidence.” Journal of Policy Modeling , no. 39 (February) :290-306

Hassan, Mohammed Kabir; Sanchez, Benito; Yu, Jung-Suk. 2017.”Financial Development and Economic Growth in The Organization of Islamic Conference Countries University of New Orleans Jung-Suk Yu School of Urban Planning & Real Estate Studies The Organization of Islamic Conference Countries.” Fothcoming in the Journal of King Abdul Aziz University-Islamic Economic.1-34

Ito, Hiroyuki. 2018.” Quantity and Quality Measures of Financial Development: Implications for Macroeconomic Performance.”Public Policy Review, no. 14 (May):803-834

Sayılır, Özlem; Doğan, Murat; Soud, Nahifa Said. 2018.” Financial development and governance relationships.” Applied Economics Letters, no. 25 (February): 1466-1470

Ruiz, Jose L. 2018.” Financial Development, Institutional Investors, And Economic Growth.” International Review of Economics and Finance, no. 54 (August):218-224

Ibrahim, Muazu; Alagidede, Paul. 2018.” Effect Of Financial Development On Economic Growth In Sub-Saharan Africa.”Journal of Policy Modeling, no.40 (June):1104-1125

Celebi, Kaan’ Hönig, Michaela. 2019.”The Impact Of Macroeconomic Factors On The German Stock Market: Evidence For The Crisis, Pre-And Post-Crisis Periods.” International Journal of Financial Studies, no. 7 (March): 1-8

Zhang, Dayong; Hu, Min; Ji, Qiang. 2020.” Financial Markets Under The Global Pandemic Of COVID-19.” Finance Research Letters, no.36 (April): 1-6

Setiawan, Satria Aji. 2020. “Does Macroeconomic Condition Matter for Stock Market ? Evidence of Indonesia Stock Market Performance for 21 Years.” The Indonesian Journal of Development Planning, no.4 (January):27-39

Fernandes, Nuno. 2020.” Economic effects of coronavirus outbreak (COVID-19) on the world economy.” SSRN Electronic Journal, 1-29

Khatatbeh, Ibrahim N; Hani, Mohammad Bani; Abu-Alfoul, Mohammed N. 2020.” The Impact of COVID-19 Pandemic on Global Stock Markets: An Event Study.” International Journal of Economics and Business Administration, no. 8 (March): 505-504

Onali, Enrico. 2020.” COVID-19 and Stock Market Volatility.” SSRN Electronic Journal, (May) 1-24

OECD. 2020.” The impact of the coronavirus (COVID-19) crisis on development finance”. Tackling coronavirus (COVID 19) Contributing to a global effort, no.100(June):468-470

Wang, Zhan; Zhang, Zhongwen; Zhang, Qiong; Gao, Jieying; Lin, Weinan. 2021.” COVID-19 And Financial Market Response In China: Micro Evidence And Possible Mechanisms.” Journal PLOS ONE, no. 16 (September):1-23

Novarinda, Putri; Mubin, Muhammad. 2021.”Financial Deepening Relationship With Economic Growth in Indonesia.” Jurnal Ilmu Ekonomi Terapan, no. 20 (January) :133

Uddin, Moshfique; Chowdhury, Anup; Anderson, Keith; Chaudhuri, Kausik. 2021.” The Effect Of COVID – 19 Pandemic On Global Stock Market Volatility: Can Economic Strength Help To Manage The Uncertainty?.” Journal of Business Research, no. 128 (June):31-44

Khan, Safi Ullah. 2021. “Financing Constraints And Firm-Level Responses To The COVID-19 Pandemic: International Evidence.” Research in International Business and Finance, no. 59 ( August):1-15

Huynh, Nhan; Dao, Anh; Nguyen, Dat. 2021.” Openness, Economic Uncertainty, Government Responses, And International Financial Market Performance During The Coronavirus Pandemic.” Journal of Behavioral and Experimental Finance, no. 31 (May):1-8

Nugroho, Ainine Devara; Robiyanto, Robiyanto. 2021.” Determinant of Indonesian Stock Market’s Volatility During the Covid-19 Pandemic.” Jurnal Keuangan dan Perbankan, no. 25 (January):1-20

Naik, Pramod Kumar; Shaikh, Imlak; Huynh, Toan Luu Duc. 2021.” Institutional investment activities and stock market volatility amid COVID-19 in India.” Economic Research-Ekonomska Istrazivanja, 1-19

Baum, Christopher F; Caglayan, Mustafa; Xu, Bing. 2021.” The impact of uncertainty on financial institutions: A cross-country study.” International Journal of Finance and Economics, no.26 (March): 1-39

Jebabli, Ikram; Kouaissah, Noureddine; Arouri, Mohamed. 2021.” Volatility Spillovers between Stock and Energy Markets during Crises: A Comparative Assessment between the 2008 Global Financial Crisis and the Covid-19 Pandemic Crisis.” Finance Research Letters, (July): 1-12

Utomo, Christian Damara & Hanggraeni, Dewi. 2021. “Dampak Pandemi COVID-19 pada Saham Kinerja Pasar di Indonesia.” The Journal of Asian Finance, Economics and Business, no. 8 (May): 777-784

Hutauruk, Martinus Robert. 2021. “Dampak Sebelum dan Sesudah Pandemi COVID-19 Terhadap Harga Saham LQ45 di Bursa Efek Indonesia.” Jurnal Riset Akuntansi dan Keuangan, no. 9 (Februari): 241-252

Gałas, A; Andrzej, S; Tost, Michael. 2021. “Impact of Covid-19 on the Mining Sector and Raw Materials.” Research Institute of the Polish Academy of Sciences, no. 10: 1-23

Laurent Calvet & Adlai Fisher. (2004) Multifractal Volatility Theory, Forecasting, And Pricing Third Edition. UK: Oxford University

Robert Alan Hill. (2010). Portofolio Theory & Financial Analyses First Edition. Kindle

Arie Arnon. (2011). Monetary Theory and Policy from Hume and Smith to Wicksell. New York: Cambridge University Press

Kiichiro Yagi, Nobuharu Yokokawa, Shinjiro Hagiwara, Gary Dymski. (2013). Crises of Global Economies and the Future of Capitalism. New York: Routledge

Jeffrey Wooldridge. (2013). Introductory Econometics A Modern Approach 5th Edition. USA: Nelson Education, Ltd

Emilio Barucci & Claudio Fontana. (2017). Financial Markets Theory Second Edition. London: Springer-Verlag London Ltd

L. Albert Hann. (2015). Economic Theory Bank Of Credit. UK: CPI Group Ltd

Damodar Gujarati & Dawn Porter. (2015). Dasar-Dasar Ekonometrika Edisi 5: Salemba Empat

Sugiyono. (2017). Metode Penelitian Kuantitatif, Kualitatif, dan R&D. Bandung: Alfabet

Downloads

Additional Files

Published

How to Cite

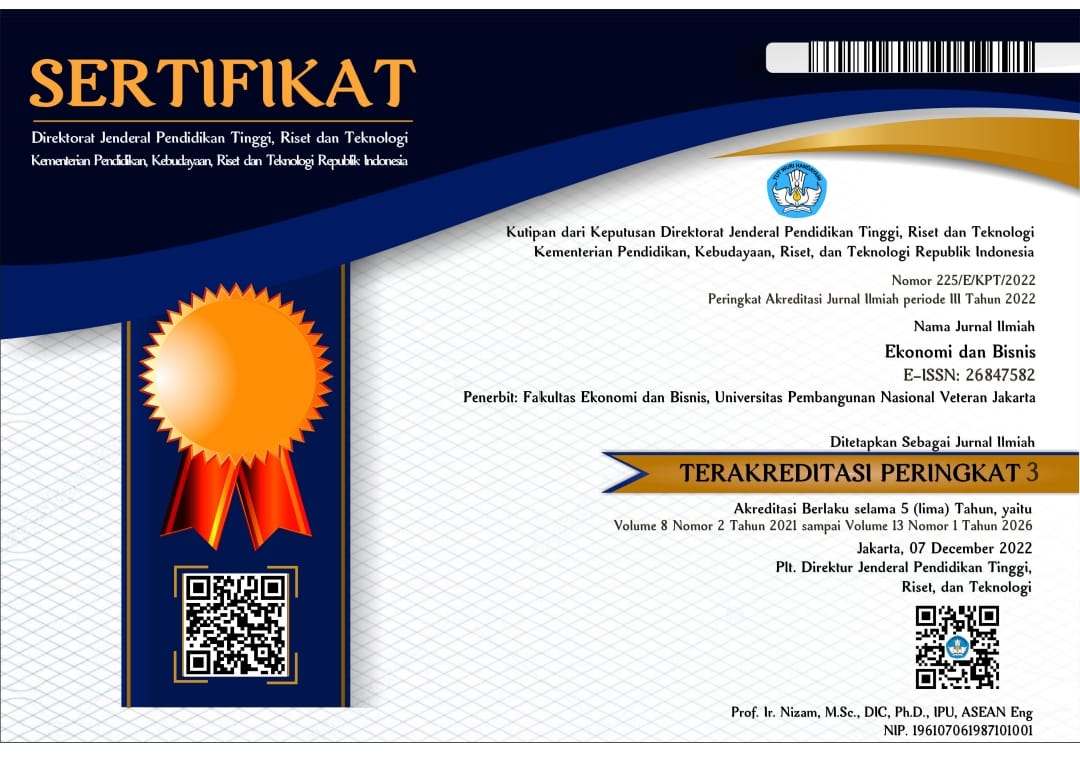

Issue

Section

License

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

Authors can enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) before and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

This work is licensed under a Creative Commons Attribution 4.0 International License.