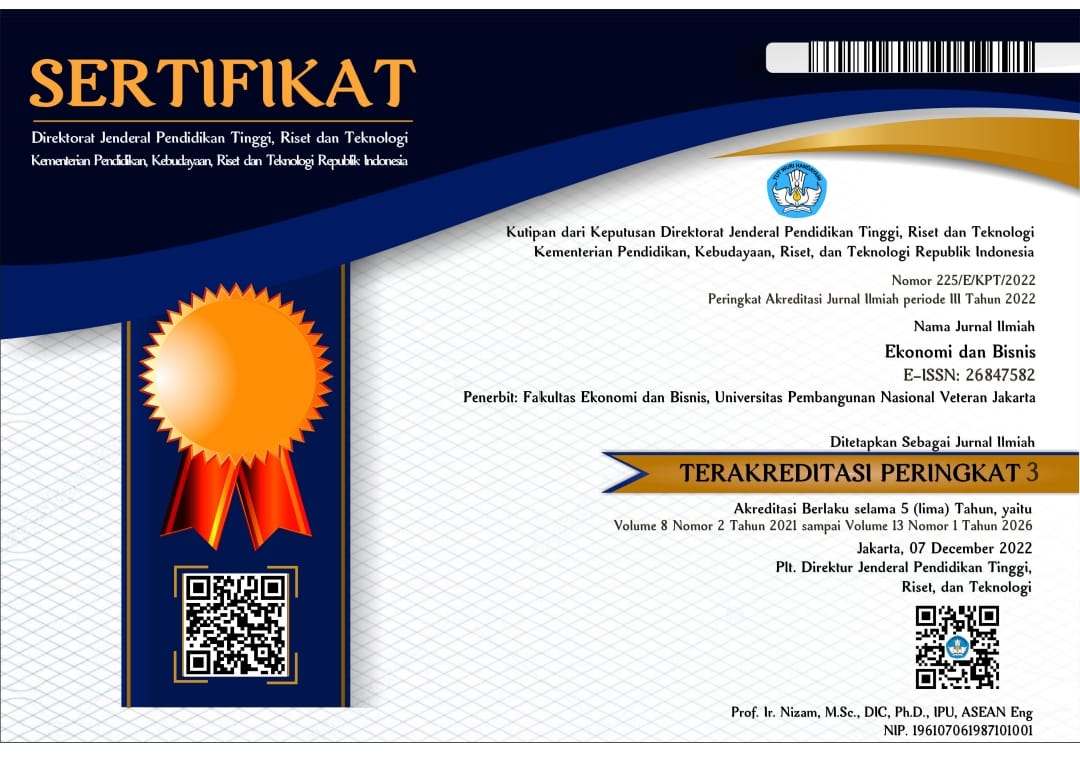

PENGARUH PROFITABILITAS, INVESTMENT OPPORTUNITY SET DAN CASH RATIO TERHADAP DIVIDEN KAS

DOI:

https://doi.org/10.35590/jeb.v2i2.715Keywords:

Profitability, Investment Opportunity Set, Cash Ratio, Cash DividendAbstract

This study aimed to examine the effect of Profitability and Investment opportunity set and the cash ratio of the Cash Dividend on wholesale services firm (durable and non durable goods), retail trade and restaurant, hotel and tourism that are listed in the Bursa Efek Indonesia 2011-2013. The population in this research study number 76 service companies listed in Bursa Efek Indonesia. Data obtained from the financial statements for 2011 to 2013 that has been published. The analysis technique used is multiple linear regression and hypothesis testing with a constant 5%. The results showed that a significant and positive effect on profitability, investment opportunity set variables and no significant negative effect and variable cash ratio and no significant negative effect. The coefficient of determination R square shows at 0.298 or 29.8% explained that the variable cash dividends is explained by the variable profitability, investment opportunity set and the cash ratio while the remaining 0,702 or 70.2% explained by other variables.

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

Authors can enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) before and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

This work is licensed under a Creative Commons Attribution 4.0 International License.