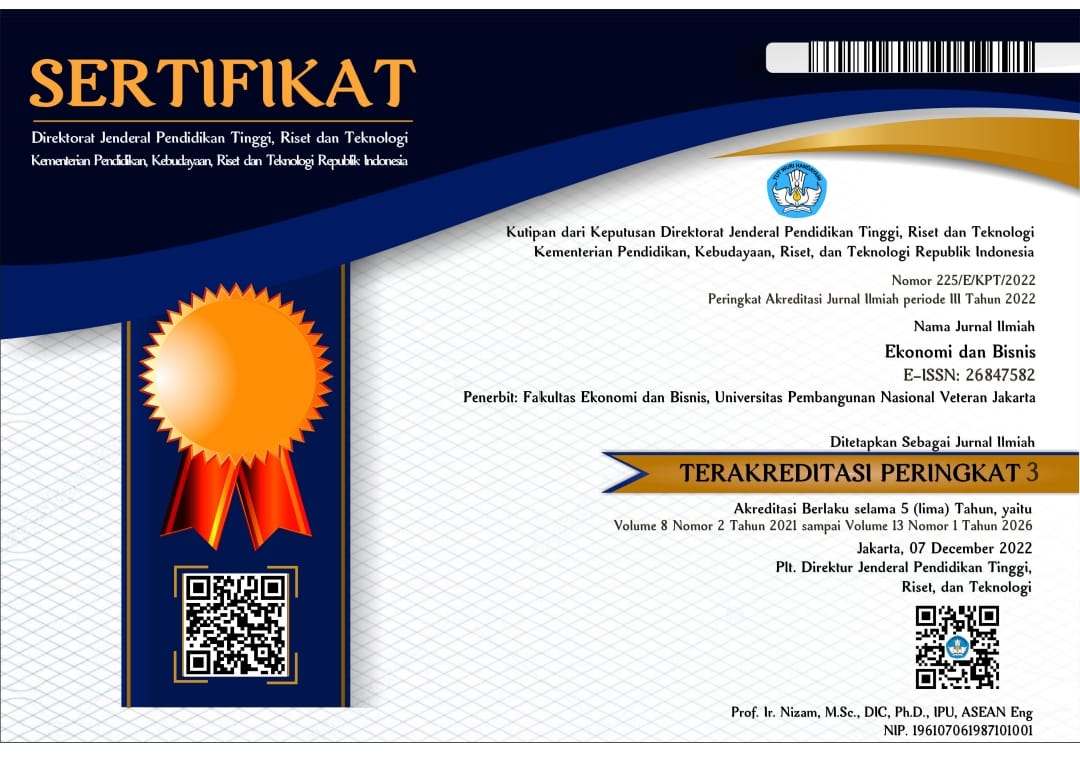

PERBANDINGAN YIELD OBLIGASI KORPORASI PADA SEKTOR KEUANGAN

DOI:

https://doi.org/10.35590/jeb.v3i2.726Keywords:

Bonds, Financial Sector, Funding Alternative, Rating, YieldAbstract

Bonds as cheap funding alternative for company and investment instrument that gives fixed income for investor make movement and development for Indonesian capital market. A lot of company issues bonds as sources of funding and supported with an excellent rating capable for getting investor’s attractive for investing in bonds, especially in financial sector as the pillar economic growth in the country. Bonds issues that dominated in financial sector give interesting yield for investor. Comparative analysis of yield can be done for knowing the differences in yield for each rating that company has. This study analysis method is Paired Samples T-test using PASW Statistics 18. The result of this study shows that on average there are significant yield differences in bonds that have idA, idAA+, and idAAA rating. This study also shows that bonds with lower rating give higher yield and the yield of bonds in banking sub-sector higher compared with the yield of bonds in multi finance sub-sectors.

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish with this journal agree to the following terms:

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

Authors can enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) before and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

This work is licensed under a Creative Commons Attribution 4.0 International License.